FEATURED BLOG POSTSDeductible Funding:

You get a big renewal and your broker suggests a plan with a deductible or a higher deductible to mitigate the renewal increase. The broker will suggest various ways to help the employee pay for the deductible, but will only push so hard because they are afraid to challenge too much which could hurt their relationship with you, their client. Who gets hurt, the employee. Why? Because of bad information coupled with poor insurance consulting. (Read More)

Compensation & Retention:

In my experience in the Government Contracting sector, compensation is basically comprised of pay in various forms and benefits. They are Base Compensation, Retention Based Compensation, and Owner/Partner Compensation from personal experience, I’ve seen the big messes when the Incentive and Retention tiers aren’t well thought out by the company. I’ve also witnessed the challenges that small businesses face when the base compensation tier isn’t well defined and left to the mercy of the hiring manager, recruiter, and human resources to negotiate per candidate. (Read More)

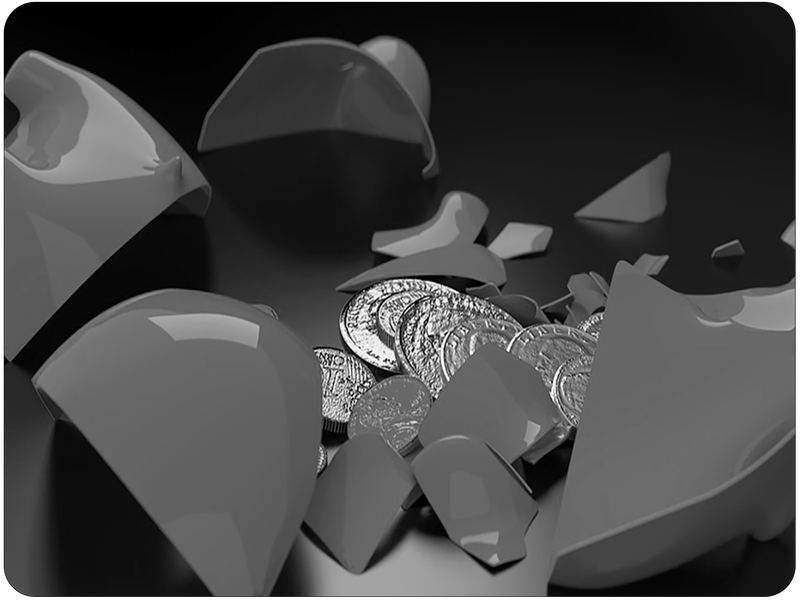

Cash in Lieu:

Ever had an employee ask for you to pay them since they aren’t taking your health insurance? I have and without a plan it’s a bit of a mess. First and foremost, having a stated corporate compensation philosophy will mitigate the risk of making decisions on the fly that could open you and your company up to liability.. Too many times I’ve seen a back of the napkin calculation from an executive wanting to hire this “rock star”.It appears disorganized and while it may provide the candidate with what he or she wants, it may compromise your company’s internal structures. (Read More)

|

Bryan Clickener (@nsurancing) is an experienced consultant with a successful history of working in insurance, retail and government contracting.

|